| Dollar Fifty Gasoline

The Canada eZine - Economics

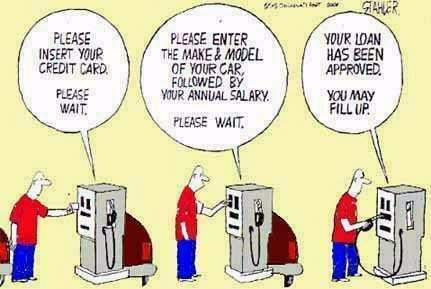

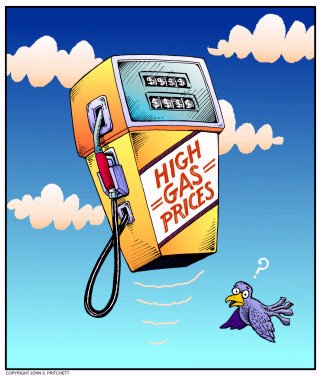

$1.50/litre of GasolineGasoline prices in Canada are set to skyrocket and it is not our fault. Canada produces 3.135 million barrels of oil/day and we only use 2.294 million barrels of oil/day. The remaining amount is exported to the United States and other countries. But American, Chinese and Indian (indeed the whole globe) is desperate for oil and it is driving oil prices up. It recently breached $100 US/barrel.

Double Whammy: Low Refinery CapacityOur demand for oil here in North America has reached a point where oil refineries can no longer keep up with demand. Pumps are running dry because gas stations can't keep the tanks full long enough for refill trucks to arrive. That is just how extreme our demand for gasoline is. The gas companies meanwhile are rolling in it. Gasoline sells faster than the proverbial pancake or flapjack. To them higher prices just means more profits. Not a lot can be done about refineries except build more of them (which is expensive and will take time), but you will notice the oil companies aren't making any effort to build more refineries. And why should they? Low refinery capacity equals higher gasoline prices during shortages and more profits. There is no reason to build refineries when they can haphazardly gouge the public's wallets and blame a refinery shortage for the problem. And nobody blames the refineries for our empty wallets. It is just a big building after all. We tend to forget that the oil companies could simply build more.

Triple Whammy: Geopolitical CrisisesAny time there is conflict over oil (or remotely associated to oil) in Russia, Iran, China, Mexico, Norway, Venezuela, United Arab Emirates, Nigeria, Kuwait, Iraq, Libya or any other country that supplies NATO with oil the prices skyrocket. These events happen so often these days the prices just get bumped higher and higher, and then settle down after awhile when peace and quiet prevails. But then the conflicts just come back again.

The Effects of High Oil Prices

We've already seen the economic results of America's mortgage crisis and its effect on Canada's soaring dollar as the US dollar and the American economy slumps into recession. But mark my words, can you imagine the results of having a housing/mortgage crisis combined with soaring oil prices? The cost of transporting goods, especially necessities like food, will skyrocket. Poor people will end up having to make difficult choices: Pay for gasoline so they can go to work or pay the mortgage. Pay for food (which costs more) or pay off that skyrocketing credit card debt? Even middle-class families will feel the pinch if we go into a depression. That's right, I said it. Depression. It is time to pay the reaper. If we spiral into a depression the middle-class families will be hard hit (although not as hard as the poor, unless they find themselves also poor) as governments will raise taxes on the middle-class in order to cover budget shortfalls. Even if governments refuse to raise taxes our government debt will continue to spiral out of control. America has already paid trillions for wars in Afghanistan and Iraq and now has a looming war with Iran. And don't think for an instant that when we finally conquer all three that our problems will disappear. America is going to be paying the economic prices of those three wars for decades to come and we will see very little benefits. People seem to assume that building a pipeline across Iraq, Iran and Afghanistan will solve our oil problems and create lower gasoline prices. But that oil pipeline is going to China, not America. These days China practically owns the United States. $7 trillion+ debt? Who do you think loaned America all that money? Chinese banks. And as for Canada's economy? Well, we export lots of our oil, gold, steel, wood and other products to China. We'll be just fine. Canada's exports to China rose 27% in 2007 alone. Canada's economy is largely resource/export reliant. We will get hit hard by an American depression, but as long as the world still needs resources we will keep exporting them. During economic depressions the price of gold soars and Canada's vast gold resources likewise will soar. Gold recently breached $900/ounce for the first time in history.

Economic PredictionsJeff Rubin, the chief economist of CIBC World Markets, says Canadians shouldn't be surprised to see gasoline at $1.50 a litre and oil at $150 (U.S.) a barrel within the near future. We agree. We think it could skyrocket during the 2008 Summer driving season. Oil depletion from existing fields is outpacing new supply, Rubin argues. We can't drill new oil wells fast enough to keep up with increasing demand. According to a CIBC report released yesterday we will run into a severe oil shortage. This report doesn't even account for unpredictable events such as escalating geopolitical tensions and extreme weather events caused by climate change. "What we don't appreciate is that the oil-sands delays (we've seen) are not a unique story. It's happening in the very fields where the world is expecting to get its future supply." "Don't think of today's prices as a spike. Don't think of them as a temporary aberration. Think of them as the beginning of a new era," Rubin says. The impact on the Canadian dollar will also be felt, he said. "Notwithstanding what's happening to the dollar now, if oil goes to $150 and the Canadian oil sands become the marginal barrel of oil (the Canadian dollar) is going up." Rubin supports the peak oil theory and believes we've already passed the peak in conventional production. He sees carbon priced at $30 a tonne and a continental cap on emissions within three years. And he says if we're serious about fighting climate change, consumers should face higher energy prices to spark meaningful conservation. Rubin correctly predicted in 2000 that oil would average $50 by mid-decade and two years ago predicted oil prices would hit $100 by the end of 2007 (Goldman Sachs made the same prediction a year earlier). Rubin also suggested back in 2005 the Canadian dollar was on its way to parity with the greenback, and last June predicted it would happen before year's end. It did. Oil consumption in the USA isn't dropping and the global demand grows strongly every year. We won't be surprised if Rubin is correct again.

|

|

Canadian exports to China continue to Skyrocket: Up 27%Canadian exports to China grew strongly in 2007 despite Ottawa's increased focus on human rights, Canada's trade minister said Monday. Exports rose about 27 per cent according to preliminary figures, International Trade Minister David Emerson said following a ceremony to open a new commercial annex at the Canadian Embassy in Beijing. "We're starting to the turn the corner. It's not where you want it to be, but you've got to start somewhere," Emerson said, referring to Canada's substantial trade deficit with China. Emerson said there have been no signs of Chinese retaliation against Canadian business following a recent meeting between Prime Minister Stephen Harper and the Dalai Lama - the first time a Canadian prime minister has met with the Dalai Lama at federal government offices. China reviles the exiled Tibetan leader as a separatist bent on ending Chinese rule there. Similar meetings between the Dalai Lama and German Chancellor Angela Merkel and U.S. President George W. Bush have drawn political and economic retaliation from Beijing. However, asked if the October meeting had resulted in specific Chinese threats against Canadian business, Emerson said: "None that have been directed at me." "They've been outspoken about that," Emerson said in acknowledging China's irritation over Harper's meeting with the Dalai Lama. "I do not believe that it will fundamentally derail the relationship," said Emerson, speaking at the beginning of a trade mission to China, Mongolia and Hong Kong that winds up Jan. 11. Canada recorded a $26.8-billion trade deficit with China in 2006 against an overall trade surplus of $43.6 billion. "We are of the view that Canada has underperformed over the last 10-15 years in terms of trade with China and our export performance in particular," Emerson said. He said Canada hoped to improve the trade balance with China with agreements boosting air transport, tourism and investment. Emerson plans to visit Mongolia later this week, where mining companies have made Canada the second-largest foreign investor. Emerson is accompanied on the trip by James Moore, parliamentary secretary for the Pacific Gateway and the Vancouver-Whistler Olympics. The trip is aimed at providing an opportunity for Canadian companies to pursue trade and investment opportunities in Asia, particularly in the air services field.

| |