| Liquor store rakes in Canadian Tire Money The Canada eZine - Funny Canadiana

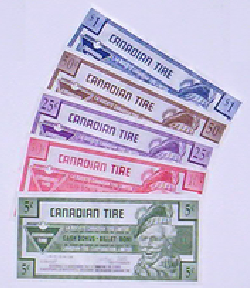

Shannon Montgomery - December 21st 2006. EDMONTON – Those who need a little liquid fortification this Christmas are finding a new source of financing it – in their junk drawers and glove compartments. A west Edmonton liquor store is accepting Canadian Tire money at par as a form of payment, and its owners say the program is a hit with shoppers. "There's a liquor store on every corner nowadays, so you need to have a bit of an edge to get someone to stop by your liquor store," said Don Calder, a part owner of Liquor International. "A lot of times, (people) just stop by to say, `Do you really take Canadian Tire money?' " he said with a laugh. Canadian Tire uses the pastel green, red, blue and brown bills as a loyalty rewards program. Each year the company gives out more that $100 million worth, in denominations ranging from five cents to $2. Calder, whose store takes in about $5 worth of the stuff on a slow day and up to $200 when things are hopping, put the policy in place about a year and a half ago. It was supposed to be a short-term gimmick but proved so popular that he's kept it up. "We do have a fair amount starting to stock up," he said. ``And, I assure you, we actually look for items now to go to Canadian Tire and buy." There are a few rules. Customers can only pay up to $50 with Canadian Tire bills. Oh, and none of those pesky five- or 10-cent ones. "We used to take them, but it just got too cumbersome at the tills," Calder said. Most people come in with a couple of dollars' worth. "It's whatever they've got in their glove box, it seems." Chris Sillito stopped by the store Thursday to pick up a couple of bottles of vodka with $50 worth of $2 coupons. "I've got lots stored up from the Canadian Tire and buying my fuel at the Canadian Tire gas bar," he said. "Now that I know about this place, I come here to buy my liquor." There are no legal problems with the store accepting Canadian Tire money, said Robyn Cochrane, a spokeswoman for the Alberta Gaming and Liquor Commission, which oversees the province's private liquor stores. Calder said everyone wants to know what a liquor store could possibly use from the retail giant. Well, he also co-owns a property management business, which buys a lot of the coupons from the liquor store. And liquor store workers who want to shop at Canadian Tire also buy them. "I kept saying I was going to buy all my Christmas presents there," said Calder. Canadian Tire officials could not immediately be reached for comment. Often jokingly called Canada's second currency, Canadian Tire bills are also accepted on ebay.ca and in some small-town bars. Some were even accidentally dispensed by a bank machine in New Brunswick in 2004. Calder said a friend of his was on an Internet chat room when someone else brought up his store's exchange program. It wasn't long before the jokes started flying "about Canadian Tire money being stronger than the Canadian currency and more stable." The bills were introduced in 1958 and since then the company has issued 21 different series. Older versions have featured a picture of a happy tire and a dollar sign running hand in hand, but the best recognized mascot is the Scottish man Sandy McTire. The bills were originally printed by the same company that printed legitimate Canadian currency and have sophisticated anti-counterfeiting technology. Over time, they have developed a fast following. Groups such as the Canadian Tire Collectors Club collect them just like any coin or stamp collector. Jerome Fourre, who edits the group's newsletter and co-wrote a guide to the "currency," has a caution for people who might want to cash all of their wayward Canadian Tire money in for some liquid Christmas cheer: some of the rarer bills can go for as much as $1,500. That's a lot of beer.

Canadian Tire money can now be earned electronically on Canadian Tire credit cards and the Canadian Tire Options MasterCard. The latter can be used wherever MasterCard is accepted and earns Canadian Tire money no matter where it is used to make a purchase As of July 12th 2006 Cardholders no longer receive a bonus for using the Canadian Tire Card or Canadian Tire Options MasterCard at Canadian Tire Associate Stores. Before this change cardholders would receive 20% more CTM than they would by paying cash, now they earn the same 1.5% as if it was cash or debit. Many customers find this to be a more convenient means of storing Canadian Tire money. CTM is treated as real currency by the franchise and can not be directly exchanged for real Canadian currency for customers. If an item bought with Canadian Tire Money is returned the customer receives either Canadian Tire Money back or is given the amount on a Gift Card. In the mid 1990's, a man in Germany was caught with up to C$11,000,000 in counterfeit Canadian Tire money. It was recovered before he left for Canada to redeem it. Lick's, the fast-food burger chain in southern Ontario also accepts Canadian Tire Money.

ATM gives customers Canadian Tire money

A CIBC cash machine started dispensing Canadian Tire money at a mall outside of Moncton, N.B. Kayla Peters, 16, said she was shocked when she withdrew $60 on Nov. 29. She received two $20 bills and two $2 bills in Canadian Tire money. "I just stood there for a second wondering what I should do, but then I heard some other people talking about it and it turned out I wasn't the only one." Canadian Imperial Bank of Commerce officials say four people have been reimbursed for the mistake. "It clearly must have come in from maybe some of our business customers who package up their own cash," said Rob McLeod, spokesperson for the bank. "We're still tracking down exactly what the source was." The ATM spat out 11 Canadian Tire bills in denominations ranging from 10 cents to $2. "It appears to be a very isolated incident," said McLeod. It's the second recent embarrassment to involve CIBC. Last week, a junkyard owner in West Virginia revealed he was suing CIBC because it failed to stop faxing him private financial information about its clients. The bank said it knew about the problem and thought it had been fixed in 2002. CIBC has ordered its employees to stop using the bank's internal fax system to send customer information between offices.

|

|